XS.com: Main features and reputation

XS.com

A top-class broker with a solid management base and advanced infrastructure technology

XS.com is an overseas FX broker based on the XS Group, which was founded in Australia in 2010, and established a new retail division for individual investors in 2023.

The XS Group, which has provided infrastructure services as a financial provider to institutional investors and other overseas FX companies, has a management structure with excellent capital and technical capabilities.

Its reliability and security are highly regarded overseas, and it can be said that it boasts outstanding stability among emerging FX brokers offering financial services to Japanese residents.

In this article, we will take a detailed look at the features and reviews of XS.com.

This article is recommended for the following people

Is XS.com safe?

I want to know about the trading environment at XS.com

I want to know how to deposit and withdraw funds from XS.com

Table of Contents

XS.com’s positive reviews and benefits

-

Narrow spreads make trading easy

-

High contract power and no order rejections (requotes)

-

Maximum leverage is 2,000x

-

Zero cut system in place, no need to worry about margin calls

-

The stop loss level is low at 20%

-

Highly reliable as it is run by a B2B broker

-

Fast deposit and withdrawal processing

-

Swap-free operation for 5 days

-

Before you start trading with XS.com

What kind of overseas FX broker is XS.com?

XS.com is an emerging overseas FX broker founded by the XS Group, which was established in Australia in 2010. In February 2023, Mohammad Ibrahim, a former globally acclaimed Exness broker , was appointed CEO, and this marked the start of the company’s financial services business for individual investors.

Based in the Republic of Seychelles, XS.com holds five financial licenses, which are difficult to obtain . This shows that the company has high technical capabilities and financial security based on B2B business. XS.com leverages its capital base and industry experience to provide reliable services to individual investors.

What are “B2B” and “B2C”?

B2B stands for “Business to Business” and refers to companies that provide services to other entities in the industry, such as providing liquidity or bridging solutions, while B2C stands for “Business to Consumer” and refers to overseas FX brokers such as XM and Exness that provide services directly to individual traders.

The group has five financial licenses.

XS.com holds five financial licenses across the group.

Licensed by XS.com Group

| XS Ltd | Seychelles Financial Services Authority (FSA): SD089 |

| XS Prime Ltd | Australian Securities and Investments Commission (ASIC): 374409 |

| XS Markets Ltd | Cyprus Securities and Exchange Commission (CySEC): 412/22 |

| XS ZA (Pty) Ltd | Financial Conduct Authority of South Africa (FSCA): 5319 |

| XS Finance | Labuan Financial Services Authority (Labuan FSA): MB/21/0081 |

| XS Ltd |

Seychelles Financial Services Authority (FSA) License Number “SD089” |

| XS Prime Ltd |

Australian Securities and Investments Commission (ASIC) license number “374409” |

| XS Markets Ltd |

Cyprus Securities and Exchange Commission (CySEC) License Number “412/22” |

| XS ZA (Pty) Ltd |

Financial Conduct Authority of South Africa (FSCA) 5319 |

| XS Finance |

Labuan Financial Services Authority (Labuan FSA) MB/21/0081 |

For Japanese users, we operate under a license from the Seychelles Financial Services Authority (FSA).

Many major overseas FX brokers that offer services to Japan, such as XMTrading , Exness , and Traders Trust (TTCM), have obtained FSA financial licenses . Because the FSA license has loose rules, it cannot be said to be a license with strict standards, but it is used to provide comfortable services such as high leverage to customers .

Why FSA license?

The FSA license is said to be relatively easy to obtain, and many overseas FX traders use it to provide services to Japan. The reason is that they can provide services with a high degree of freedom that cannot be achieved with strict licenses such as the UK Financial Conduct Authority (FCA) and the Cyprus Financial Services Commission (CySEC). Licenses such as the FCA (UK Financial Conduct Authority), CySEC, and ASIC (Australian Securities and Investments Commission) only allow leverage up to several tens of times, so they choose to provide services with a high degree of freedom with the FSA license, which has looser rules.

In addition to the FSA financial license, the company also holds financial licenses from CySEC, ASIC, FSCA, and Labuan FSA, so it can be said that there are no problems with its financial soundness or management foundation.

In particular, CySEC and ASIC have a reputation for having very strict financial licenses , and are one of the criteria for choosing a broker’s safety, reliability, and management stability.

Customer assets are completely segregated

XS.com’s customer funds management method is completely segregated . There are many benefits to an overseas FX broker completely segregating customer assets.

Generally, when overseas FX brokers manage their operating funds and customer funds together, large market fluctuations or errors in judgment by the broker can affect users’ funds.

However, full segregation ensures that user funds are separated from the broker’s operating funds, so even if XS.com faces financial problems, user funds will be kept safe .

Segregated management and trust preservation

In the overseas FX industry, two different methods are used to protect user funds: “segregated management” and “trust protection.”

In the case of segregated management, the overseas FX broker clearly separates the funds of the users from its own funds. This means that even if the overseas FX broker faces some kind of problem, the funds of the users will not be affected.

On the other hand, with trust protection, users’ assets are entrusted to an independent third party such as a trust bank, and their safety is maintained even if the overseas FX broker goes bankrupt. However, implementing trust protection is complicated and costly, so the reality is that most overseas FX brokers adopt segregated management.

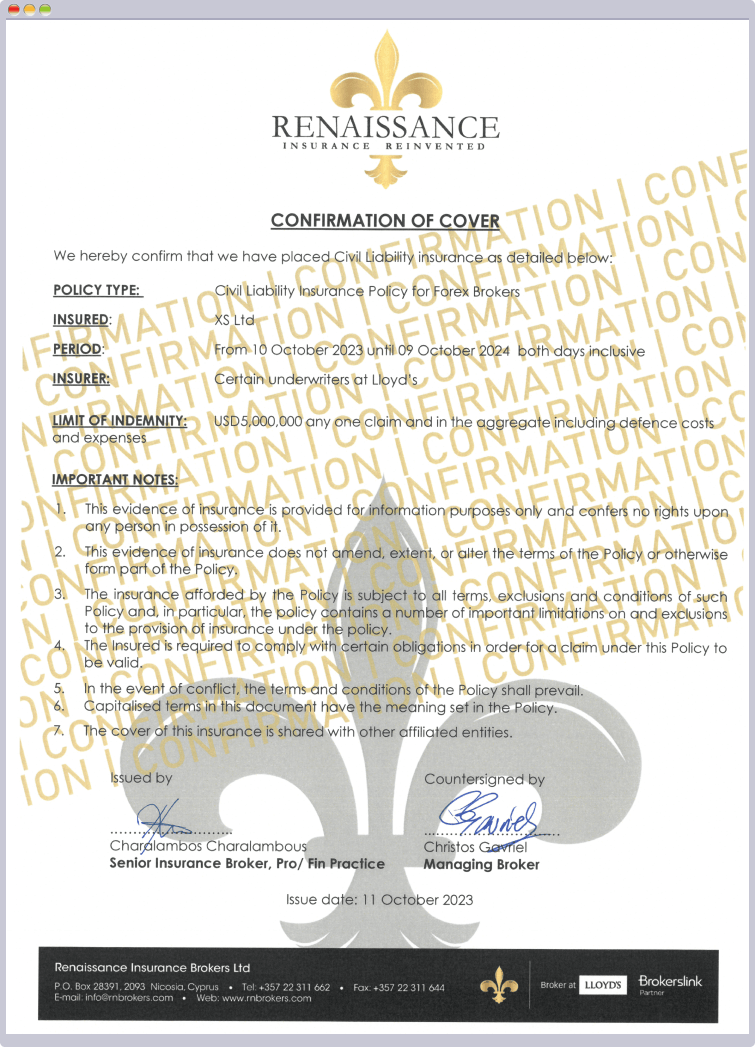

Broker compensation insurance ensures high security of funds

XS.com is covered by the civil liability insurance program of Lloyd’s of London, an insurance company with a reputation for being one of the largest in the world, so the safety of your funds is extremely high .

XS.com’s civil liability insurance program provides additional coverage for losses over $10,000 and up to $5 million in the event of bankruptcy .

This insurance covers liability for all risks of negligence or omission, fraud, and financial loss to clients and third parties, and brokers who have this insurance have a reputation for being highly financially secure.

Five account types available to suit your trading needs

XS.com offers four different account types: Cent Account, Standard Account, Elite Account, and Pro Account.

XS.com Account Type Features

| Target users | Account Type |

| Beginner to intermediate level | Cents / Standard |

| For intermediate to advanced | Elite/Pro |

| Beginner to intermediate level |

|---|

| Cents / Standard |

| For intermediate to advanced |

| Elite/Pro |

To familiarize yourself with the trading environment at XS.com, we recommend starting with a Standard Account, which has no minimum deposit .

Also, if you want to try out automated trading systems (EA) with small amounts, a cent account, which allows transactions from 1,000 currency units , is suitable.

In addition, the “Elite Account” and “Pro Account” are account types that feature low spreads and can accommodate a variety of trading styles , from scalping to swing trading .

These account types have a slightly higher minimum deposit of $500, but offer excellent performance that matches the deposit requirements.

XS.com’s positive reviews and benefits

The biggest advantage of XS.com is the highly reliable trading environment that comes from their experience in running their own B2B business . Not only does it have a high contract rate and no order rejections (requotes), but it also has a narrow spread and the ability to keep total costs low, which is another attractive feature of XS.com.

Narrow spreads make trading easy

XS.com provides financial services to customers through its provider, XS Fintech Ltd, the technology division of the XS Group.

This enables us to settle orders directly in-house with the interbank market without going through another company’s LP , allowing us to offer extremely narrow spreads.

As you can see below, trading costs have been highly rated by users.

They say super low spreads and they really are!

Thanks to them, my trading costs have dropped so dramatically that my portfolio has literally outperformed!

Source: Trustpilot

Comparison of spreads between XS.com and other companies

| Overseas FX Brokers | EURUSD | USDJPY | US30 | BTCUSD |

Pro Account Pro Account | 0.6 pips | 0.8 pips | 2.6 pips | 46.0 pips |

| 0.7 pips | 1.4 pips | 8.5 pips | 72.2 pips | |

KIWAMI Polar Account KIWAMI Polar Account | 1.1 pips | 1.3 pips | 4.1 pips | 61 pips |

Blade Account Blade Account | 0.8 pips | 1.3 pips | 5.0 pips | 74.4 pips |

Pro Account Pro Account | |

| EURUSD | 0.6 pips |

| USDJPY | 0.8 pips |

| US30 | 2.6 pips |

| BTCUSD | 46.0 pips |

| EURUSD | 0.7 pips |

| USDJPY | 1.4 pips |

| US30 | 8.5 pips |

| BTCUSD | 72.2 pips |

As you can see from the table above, XS.com offers tighter spreads on many instruments than other companies.

In particular, stock indexes have a much narrower spread than other companies, so those who mainly trade stock indexes will find it useful for trading the Dow or Nasdaq. Stock index trading is most active at night, so it is also perfect for part-time traders.

High contract power and no order rejections (requotes)

XS.com leverages its network as an LP (liquidity provider) to execute trades quickly and at competitive prices.

XS.com has excellent liquidity and minimizes slippage , so if you are concerned about the execution power of other companies, you should consider switching to XS.com.

In addition, XS.com does not have requotes (rejection of contracts) . Because there are no requotes, XS.com has an environment where you can easily carry out scalping trades using narrow spreads .

Slippage and Requotes

Slippage refers to the difference between the price ordered and the price that is executed when trading. Requotes occur when a trader places an order and is unable to execute at the desired price due to sudden market fluctuations or a decrease in liquidity, and instead the broker proposes a trade at a different price. Since requotes are not executed on the spot, general users also see them as a refusal to execute. Both slippage and requotes are likely to occur when market liquidity is low or prices are fluctuating rapidly.

Maximum leverage is 2,000x

At XS.com, you can use leverage of up to 2,000 times , which is quite high in the industry. This is a big advantage for traders who want to take on large transactions with a small amount of capital.

In addition, XS.com uses ” dynamic leverage, ” which changes the leverage depending on the trading situation .

XS.com Dynamic Leverage has two standards: “Equity-Based (EQ Account)” and “Lot-Based (LT Account)”.

You can choose from the leverage limit by account balance and the leverage limit by trading lot number according to your trading style and fund management policy. The effective margin base (EQ account) is only available when you select MT5 as your trading platform.

XS.com Leverage Limits

| Leverage Standards | Lot-based (LT account) | Equity basis (EQ Account) |

| Features | Maximum leverage varies depending on the number of lots held | Maximum leverage varies depending on the available margin |

| Applicable Platform | MT4 / MT5 | MT5 |

| Account Type Name | Account name includes “EQ” (e.g. EQ Standard Account) | Account name includes “LT” (e.g. LT Standard Account) |

| Features | |

| LT Account | Maximum leverage varies depending on the number of lots held |

| EQ Account | Maximum leverage varies depending on the available margin |

| Applicable Platform | |

| LT Account | MT4 / MT5 |

| EQ Account | MT5 |

| Account Type Name | |

| LT Account | Account name includes “EQ” (e.g. EQ Standard Account) |

| EQ Account | Account name includes “LT” (e.g. LT Standard Account) |

XS.com’s dynamic leverage allows traders to trade not only major currency pairs, but also volatile precious metal pairs (gold) with up to 2,000x leverage, making this a leverage setting that will satisfy even traders who want to take on riskier trades.

Another major benefit is that , despite being a broker with extremely narrow spreads, you can trade up to 2 lots of virtual currencies (BTC and ETH) at up to 500x the normal rate .

Margin-based dynamic leverage was introduced on April 8, 2025. Accounts before the introduction will be subject to lot-based dynamic leverage.

Zero cut system in place, no need to worry about margin calls

XS.com, like many overseas FX brokers, uses a zero-cut system . In FX trading that makes full use of high leverage, if the market moves suddenly, large losses can occur, but with the zero-cut system, losses will not exceed the account balance.

By trading with a broker that adopts zero cut, such as XS.com, you can trade with peace of mind even with high leverage transactions of 500x or 1,000x .

The stop loss level is low at 20%

XS.com’s stop loss level is set at 20%. Stop loss is a system that automatically closes a position when losses reach a certain level.

This 20% stop loss level is set lower than other companies, and a low stop loss level is considered advantageous for efficiently utilizing high leverage .

Comparison of stop loss levels between XS.com and other companies

However, you should be careful about low stop loss levels. If you are hit with a stop loss due to a sudden market fluctuation, the lower the stop loss level, the less funds you will have left . On the other hand, if the stop loss level is high, you will have more funds left at the time of stop loss, but if you are trading with high leverage, your position will be closed unexpectedly quickly , which can be a source of stress.

Highly reliable as it is run by a B2B broker

XS Group, the parent company of XS.com, is known as a B2B (business-to-business) broker with over 10 years of experience and has earned a high reputation overseas for its safety and reliability.

A very reliable platform for me

When I first discovered XS.com, it met all my expectations. I am pretty careful when it comes to choosing my brokers and never let my guard down. You get the idea, right? For me, a broker must have a solid track record, bulletproof regulation, a large number of clients from around the world, operations in diverse jurisdictions, more than one trading platform, a large number of assets, good customer service, and a good reputation.

Luckily, XS.com cleared all of this rigorous process for me and fulfilled it without any issues, I trust them and have been doing business with them without any issues.

Source: Trustpilot

You may not know this, but behind the broker is the entire XS Group.

And each entity in this group holds various licenses from different regulatory authorities, so we are not surprised by the great trading conditions offered by XS.com.

Source: Trustpilot

In the B2B model, companies provide products or services to other companies, and XS Group has established itself in that field so far primarily by providing liquidity to overseas FX brokers.

B2B brokers are in the business of acting as intermediaries for financial settlement orders, and are required to have large capital and transparency in their operations. XS.com, which belongs to the B2B broker category , has extremely ample capital and can be said to be a highly reliable overseas FX broker .

Fast deposit and withdrawal processing

Not only with XS.com, but the speed of deposits and withdrawals is an important factor when choosing an overseas Forex broker. XS.com has also earned a high reputation for its speed of deposits and withdrawals.

I was amazed at the high level of customer service.

Great broker, very fast deposits and withdrawals and I must mention their great support at BR. Highly recommended. They give full attention to their customers and also provide personalized support. In all my experience in the financial markets, I have not found any other broker with better customer support and security.

Source: Trustpilot

XS.com accepts the following payment methods: domestic bank transfer, credit/debit card, cryptocurrency, and online wallet. All payment methods are reflected instantly or within an hour , so you won’t miss an opportunity even in an emergency. Card payments, cryptocurrency, and online wallets are particularly fast, with most payments arriving within a few minutes .

The same applies to withdrawals. Withdrawals from “cryptocurrency” and “online wallets” are reflected in as little as a few minutes, and at most within 45 minutes . For domestic bank transfers, it depends on the time of the withdrawal request, but it is usually reflected on the next business day .

On the other hand, withdrawals using “credit/debit cards” are made using a method called “chargeback.” In this case, the time it takes to withdraw depends on the card company, not XS.com, so it may take longer or shorter than the withdrawal time stated by XS.com (10 business days). XS.com will process the withdrawal request promptly, but depending on the card company, it usually takes about one to two weeks for the funds to arrive.

Check available deposit and withdrawal methods

Which withdrawal method is fastest?

The fastest withdrawal times from XS.com are for “online wallets” and “cryptocurrency.” Although “online wallet” withdrawals are quick from XS.com, it takes one business day to withdraw from an online wallet. On the other hand, “cryptocurrency” withdrawals arrive within about 30 minutes of submitting a withdrawal request on XS.com. Cashing out into Japanese yen depends on the withdrawal time of the cryptocurrency exchange, but some domestic exchanges offer withdrawal methods using electronic money that can be quickly converted into cash, so the fastest way to withdraw is to use a cryptocurrency exchange that has a linked service with electronic money such as Merpay or LINE Pay.

Swap-free operation for 5 days

XS.com introduced swap-free in June 2024. Although it is only swap-free for five days , it will definitely come in handy in situations where you hold a position and it is not settled for several days.

In addition, XS.com has mentioned that they will not abolish swap-free individually like XM and Exness . Even though it is for a short period of time, it is a point that can be appreciated as it is reliable and trustworthy.

Bad reputation and disadvantages of XS.com

XS.com is unique in that it offers high-spec accounts compared to other companies, but perhaps because it places emphasis on allocating resources to the trading environment, the design of its official website gives off a simple impression.

While some users may find this simplicity convenient and easy to use, others may find it lacking.

In addition, XS.com does not offer the generous deposit bonuses that are often seen in overseas FX brokers. For this reason, XS.com is considered to be a broker that targets intermediate to advanced traders in particular . For beginners, the lack of information is a disadvantage of XS.com, which makes it seem difficult to get started.

No deposit or account opening bonuses offered

XS.com does not offer any bonus campaigns like those offered by many overseas FX brokers.

One of the great attractions of overseas Forex is the ability to aim for large profits from small amounts by utilizing bonuses and high leverage, but since XS.com does not offer bonuses, it may be inferior in some ways to the generous deposit bonuses of other companies.

However, it is important to consider the possibility that offering bonuses would make it difficult to maintain an excellent trading environment. In order to maintain the quality of trading conditions that are important to traders, such as low spreads and high execution power, resources must be focused on these elements. XS.com has earned its current reputation as a superior broker by adopting a strategy that does not rely on bonuses .

No analytics tools or webinars

XS.com focuses on simplicity and high-quality service, which is why they do n’t offer any of the extra content such as instructional videos, webinars, or analytical tools that brokers like XM and HF Markets offer .

This lack of additional content will be a bummer for users who want to use third-party services such as Trading Central or Autochartist, as well as for beginner and intermediate traders who want to learn about Forex trading.

Before you start trading with XS.com

Experience trading with a demo account

XS.com offers a demo account that allows you to experience trading with virtual funds as a service that allows you to check the trading environment before opening a real account.

Opening a demo account allows you to test the functionality and usability of the XS.com trading platform without risking any real funds.

Just like real accounts, demo accounts can be opened after completing identity verification. If identity verification has been completed, please log in to the customer portal using the button below and proceed with the procedure by clicking “Open a demo account”.

How to open a trading account

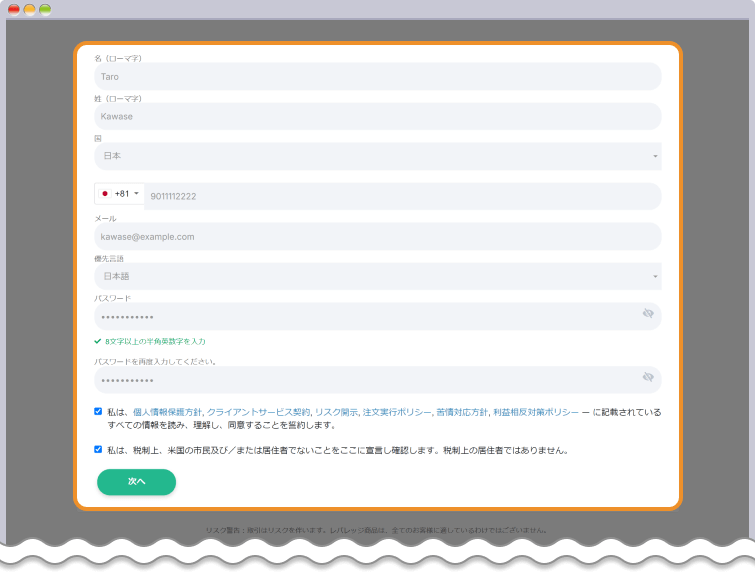

To open an account with XS.com, follow the steps below:

- Register your name, date of birth, email address and password, then authenticate with the registered email address.

- Answer questions about your trading experience and complete the initial registration

- Register personal information and submit identity verification documents (all services including withdrawals are available)

STEP 1 Account opening application

On the account opening application screen, enter your name, phone number, email address, preferred language, and password, and click “Next.”

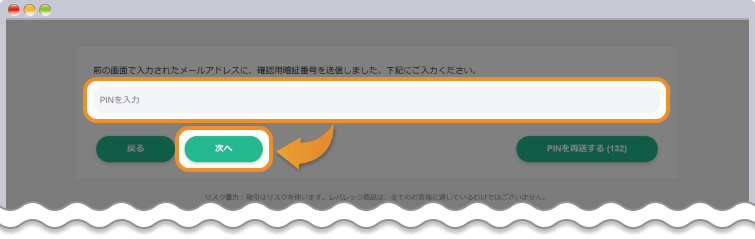

Enter the PIN code sent to the email address you entered and click “Next”.

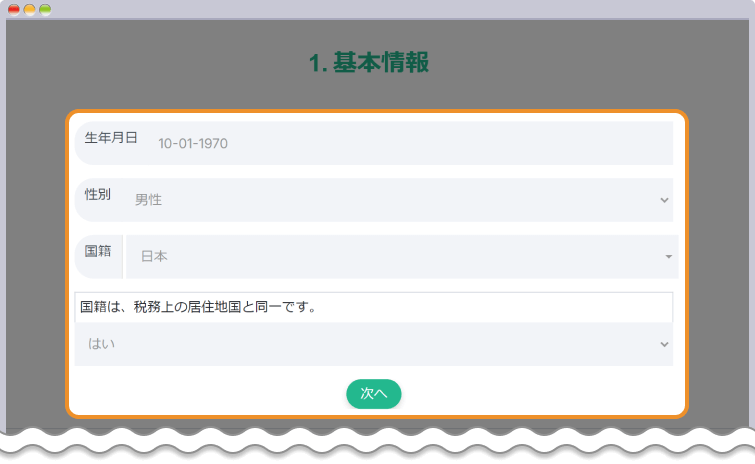

STEP 2 Enter your personal information and financial situation

Enter your personal information such as your date of birth and nationality, as well as your employment status and financial situation.

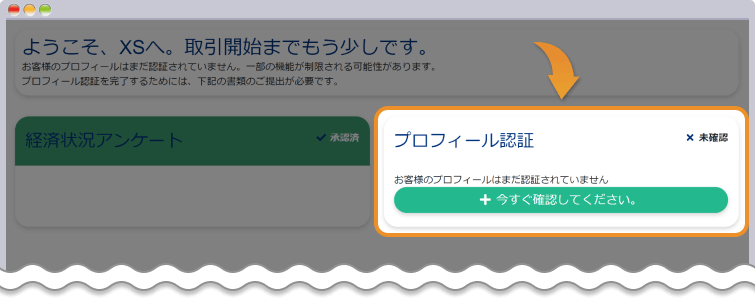

STEP 3 Upload your identity verification documents

Please submit your identity verification documents and address verification documents from “Profile Verification” on your My Page. The documents that can be used for profile verification are as follows.

Identification documents

- driver’s license

- My Number Card

- Basic Resident Registration Card

- passport

Address verification document (※)

- My Number Card

- driver’s license

- Residence card

- Resident card

- Bank Account Statement

- Utility bill/Mobile phone bill

Issued within the last six months

For more information on how to open an account with XS.com, please see the article below.

How to log in to My Page

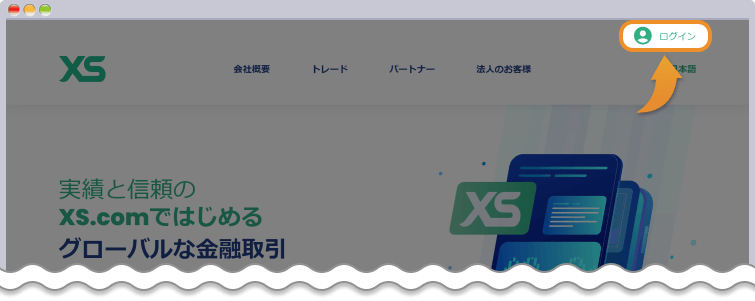

To log in to XS.com, click “Login” in the upper right corner of the official website.

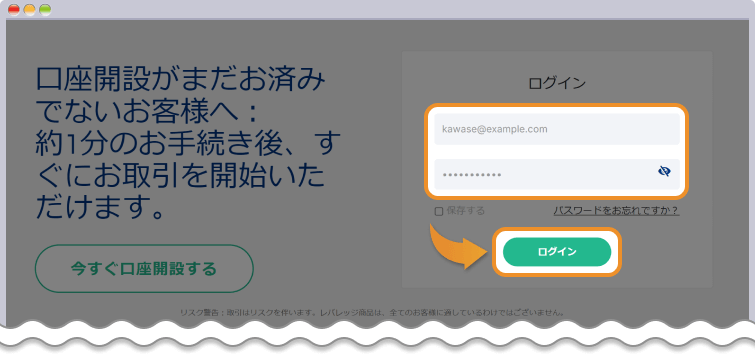

Enter your email address and password in the login page and click “Login”.

Check available deposit and withdrawal methods

List of deposit methods

The reflection period and minimum deposit amount for XS.com’s deposit methods are as follows. All deposit methods are free of charge.

Deposit Methods at XS.com

| Deposit Methods | Reflection period | Minimum Deposit |

| Domestic bank transfer (1) | Within about 1 hour | 1,000 yen |

| Domestic bank transfer (2) | 700,000 yen | |

| International Bank Transfers | 1-7 Business Days | 250 USD |

| Credit/Debit Cards | Immediate | 20 USD |

| Cryptocurrency | Within about 30 minutes | 50 USD equivalent |

| MiFinity | Within about 1 hour | 10 USD |

| STICPAY | ||

| bitwallet | Within about 30 to 45 minutes | 100 yen |

| Perfect Money | 50 USD |

| Domestic bank transfer (1) | |

| Reflection period | Within about 1 hour |

| Minimum Deposit | 1,000 yen |

| Domestic bank transfer (2) | |

| Reflection period | Within about 1 hour |

| Minimum Deposit | 700,000 yen |

XS.com offers two types of domestic bank transfers in case of problems with the payment processing agency. However, the minimum deposit amount for “Domestic Bank Transfer (2)” is high at 700,000 yen, and the withdrawal amount is also inconvenient at 80,000 yen, so we basically recommend using Domestic Bank Transfer (1).

Withdrawal methods list

The fees, reflection period, and minimum withdrawal amount for XS.com withdrawal methods are as follows.

Withdrawal methods at XS.com

| Withdrawal Methods | Travel time | Minimum Withdrawal Amount |

| Domestic bank transfer (1) | 1 business day | 1,000 yen |

| Domestic bank transfer (2) | 80,000 yen | |

| International Bank Transfers | 1-7 Business Days | 250 USD |

| Credit/Debit Cards | 10 business days | 5 USD |

| Cryptocurrency | Within about 30 minutes | 10 USD |

| MiFinity | ||

| STICPAY | Within about 30 minutes | 10 USD |

| bitwallet | Within about 30 to 45 minutes | 100 yen |

| Perfect Money | 15 USD |

| Domestic bank transfer (1) | |

| Reflection period | 1 business day |

| Minimum Withdrawal Amount | 1,000 yen |

| Domestic bank transfer (2) | |

| Reflection period | 1 business day |

| Minimum Withdrawal Amount | 80,000 yen |

Summary and review from XS.com

XS.com is a B2B broker with over 14 years of experience and extensive financial resources, providing safe and reliable services.

Although there is a drawback in that some information is lacking on the official website, there are many great benefits for users, such as compensation insurance of up to $5 million and a fast withdrawal process, so it is expected to gain a good reputation overall.

In addition, XS.com features narrow spreads that utilize its own liquidity. It also has unrivaled products such as BTCUSD, which will be one of the major attractions of XS.com.

Although XS.com only just launched in 2023, its capabilities are full of unfathomable potential. For traders looking for a balance between security and a trading environment, XS.com is undoubtedly an attractive option.

Please try out XS.com’s excellent trading environment, which is developed with advanced technology.

More information on XS.com

Operating company information

| Company Name | XS Ltd | ||

| Head office address | Office No. 13, Third Floor, Ebrahim Building, Victoria, Mahe, Seychelles | ||

| Financial Supervisory Authority | Seychelles Financial Services Authority (FSA) Licence Number SD089 | ||

| Founded | 2023 | Capital | private |

Japanese support and support desk

| Japanese site | Both the website and portal are available in Japanese. |

| Trading Tools | Both MetaTrader4 and 5 are available in Japanese. |

| Japanese Language Support | We have Japanese staff on staff, and respond to users via email and chat . |

| Support response (Japan time) | [Chat] 9:00 to 1:00 (weekdays) [Email] 24-hour reception |

| email address | support@xs.com |

| telephone number (※) | +248 4671916 |

As this is an international call, the customer will be responsible for the call charges.

Terms of trade and deposit protection rules

| Trading Account Types | Cent | Standard |

| Rollover | [Japan time / Summer time]: 6:00 a.m. [Japan time / Winter time]: 7:00 a.m. | |

| Margin Call | If the margin maintenance rate falls below 60% | If the margin maintenance rate falls below 40% |

| Stop Loss | If the margin maintenance rate falls below 10% | If the margin maintenance rate falls below 20% |

| Hedging | Yes | |

| EA Usage Restrictions | none | |

| Margin call request | None (If margin becomes negative, zero cut will be implemented) | |

| Deposit storage method | Separate storage | |

| Trading Account Types | elite | professional |

| Rollover | [Japan time / Summer time]: 6:00 a.m. [Japan time / Winter time]: 7:00 a.m. | |

| Margin Call | If the margin maintenance rate falls below 40% | |

| Stop Loss | If the margin maintenance rate falls below 20% | |

| Hedging | Yes | |

| EA Usage Restrictions | none | |

| Margin call request | None (If margin becomes negative, zero cut will be implemented) | |

| Deposit storage method | Separate storage | |

| Margin Call | |

| Cent | If the margin maintenance rate falls below 60% |

| Standard Elite Pro | If the margin maintenance rate falls below 40% |

| Stop Loss | |

| Cent | If the margin maintenance rate falls below 10% |

| Standard Elite Pro | If the margin maintenance rate falls below 20% |

| Hedging | |

| Yes | |

| EA Usage Restrictions | |

| none | |

| Margin call request | |

| None (zero cut) | |

| Deposit storage method | |

| Separate storage | |

| Rollover | |

[Japan time / Summer time]: 6:00 a.m. [Japan time / Winter time]: 7:00 a.m. | |

Terms and conditions for each account type

| Trading Account | Cent | Standard |

| Trading Tools | MetaTrader5 | MetaTrader4 / MetaTrader5 |

| Ordering Method | NDD method | |

| Spread Method | Variation method | |

| Trading Account Currency | U.S.C. | JPY / USD |

| Maximum Leverage | 2,000 times (※1) | |

| First minimum deposit | Not set | |

| Currency amount per lot | 100,000 cents | 100,000 currency |

| Minimum Order Quantity | 0.01 lot | |

| Maximum Order Quantity (Total Maximum Order Quantity) | 500 lots / 500 lots | 50-100 lots, no limit (*2) |

| Product (brand) | <MetaTrader5> [Total products] 49 [FX/currency pairs] 47 [CFD/precious metals] 2 | <MetaTrader4> [Total products] 78 [FX/currency pairs] 43 [CFD/precious metals] 7 [CFD/stock index] 11 [CFD/energy] 7 [CFD/cryptocurrency] 10 <MetaTrader5> [Total products] 794 [FX/currency pairs] 44 [CFD/precious metals] 7 [CFD/stock index] 15 [CFD/stocks] 711 [CFD/energy] 7 [CFD/cryptocurrency] 10 |

| Trading hours | [Japan time / Summer time]: (Monday) 6:00 AM to (Saturday) 5:59 AM [Japan time / Winter time]: (Monday) 7:00 AM to (Saturday) 6:59 AM | |

| Trading fees | free | |

| Account maintenance fee | none | |

| Holding multiple accounts | Possible (up to 10 accounts) | |

| GMT time difference | [MT4/MT5] Summer time: +3 hours, Winter time: +2 hours | |

| Trading Account | elite | professional |

| Trading Tools | MetaTrader4 / MetaTrader5 | |

| Ordering Method | NDD method | |

| Spread Method | Variation method | |

| Trading Account Currency | JPY / USD | |

| Maximum Leverage | 2,000 times (※1) | |

| First minimum deposit | 500 USD equivalent | |

| Currency amount per lot | 100,000 currency | |

| Minimum Order Quantity | 0.01 lot | |

| Maximum Order Quantity (Total Maximum Order Quantity) | 50-100 lots / No limit (※2) | |

| Product (brand) | <MetaTrader4> [Total products] 78 [FX/currency pairs] 43 [CFD/precious metals] 7 [CFD/stock index] 11 [CFD/energy] 7 [CFD/cryptocurrency] 10 <MetaTrader5> [Total products] 794 [FX/currency pairs] 44 [CFD/precious metals] 7 [CFD/stock index] 15 [CF/stocks] 711 [CFD/energy] 7 [CFD/cryptocurrency] 10 | |

| Trading hours | [Japan time / Summer time]: (Monday) 6:00 AM to (Saturday) 5:59 AM [Japan time / Winter time]: (Monday) 7:00 AM to (Saturday) 6:59 AM | |

| Trading fees | 3 USD (※3) | free |

| Account maintenance fee | none | |

| Holding multiple accounts | Possible (up to 10 accounts) | |

| GMT time difference | [MT4/MT5] Summer time: +3 hours, Winter time: +2 hours | |

| Ordering Method |

| NDD method |

| Spread Method |

| Variation method |

| Maximum Leverage |

| 2,000 times (※1) |

| Trading hours (Japan time) |

[Summer Time]

[Winter time]

|

| Account maintenance fee |

| none |

| Holding multiple accounts |

| Possible (up to 10 accounts) |

| GMT time difference |

| [MT4/MT5] Summer time: +3 hours Winter time: +2 hours |

- here .Learn moreabout XS.com’s leverage limits

- The maximum order size varies depending on the time of day. From 6:00 to 15:59 JST, the maximum order size is 50 lots, and from 16:00 to 5:59 JST, the maximum order size is 100 lots.

- This is the fee per order (one way).

XS.com – Frequently Asked Questions (FAQ)

We have compiled a list of frequently asked questions about XS.com.

No, XS.com uses a zero-cut system, so there is no margin call. Even if your account balance goes into the negative due to a sudden price fluctuation, the negative balance will be reset to zero, so you can rest assured.

Yes, XS.com has Japanese staff who provide support in Japanese via email and live chat. Chat support hours are from 9:00 to 1:00 on weekdays, Japan time.

At XS.com, you can deposit funds via bank transfer, credit/debit card, cryptocurrency, and online wallets. All payment methods are reflected instantly or within an hour.

XS.com is a broker that values the trading environment, so it does not offer bonuses or campaigns. As a campaign unique to our company, FXplus, we offer a 3,000 yen cashback that can be withdrawn to customers who open a new XS account through our company. You can apply for the cashback campaign when you meet the conditions set by our company.

XS.com offers two professional accounts, the Elite Account and the Pro Account, but only the Elite Account incurs transaction fees. The fee is equivalent to $3 per lot, one way.

When using overseas FX, we provide content that even beginners to overseas FX can use with confidence, such as the latest overseas FX popularity rankings and free account opening services with overseas FX companies.

At FXplus, we welcome your opinions and feedback on our articles.

Please send any rare information about overseas FX or insider information from industry insiders to our editorial department.

We are also always looking for writers who can write articles on a regular basis!

Contact: support@fxplus.com

(please change the capital letter “@” to lowercase)

The information published in our “Foreign FX Broker Reviews” is for informational purposes only and is not intended to solicit any investments.

This information was compiled based on sources that we deemed reliable at the time of compilation, but we do not guarantee or assume any responsibility for the accuracy, completeness or timeliness of the content and information. Please make the final investment decision yourself.

This content was created independently by our company (FXplus), and unauthorized use of the data posted on this site is prohibited. If you wish to use any of the posted articles for secondary purposes, please contact us.

Overseas FX Broker Popularity Ranking >

Exclusive to this site

Current campaign information

Related articles

-

New!

A thorough explanation of the features of XS.com account types and how to choose the best one

-

Detailed explanation of how to open an account and authenticate yourself with XS.com (XS)

-

Detailed explanation of how to install XS.com’s MT4/MT5!

-

Compare XS.com’s spreads with other companies! We also have the lowest trading costs in the industry.

-

List of XS.com swap points | Ranking of profitable stocks!